The Microsoft Power Platform Conference is a global event that brings together top experts in the Power Platform field. It is filled with workshops, presentations, and educational sessions led by individuals with extensive experience and achievements. One of the speakers at the conference held in Las Vegas was Jakub Skałbania, the founder and CGO of Netwise. His session, “Next gen GPT automation with AI Builder and Power Automate,” was the most sought-after presentation during the second day of the MPPC.

What was the presentation about?

The presentation focused on a case study of a solution implemented at Nsure, a long-time client of Netwise. Nsure.com is a platform operating in the USA for purchasing insurance online, enabling transparent comparison of home and auto insurance offers from over 60 top-rated insurers and allowing customers to purchase a policy within minutes. The system is based on Power Platform, Dynamics 365, and Azure services, automating most of the processes

You can learn more about Nsure and the innovative solutions previously implemented by Netwise in a case study prepared by Microsoft two years ago:Â link.

After designing and implementing the latest solutions, automation at Nsure reached a much higher level, harnessing the full potential of artificial intelligence and the GPT language model.

Summarization

Many companies struggle with maintaining consistent communication with customers, let alone assigning the right actions to the appropriate department. The latest flow built at Nsure enables Power Automate to “read” hundreds of emails and then use the GPT model to generate summaries that go directly to the designated team in Teams according to the scenario. This impacts customer comfort, service speed, and response time to sales opportunities. As a result, it may happen that before the competition even reads the email, the customer already has a response from Nsure in their inbox.

Information extraction

Even just the bot’s email screening, data extraction, and placement in a ready-made file automate processes and relieve agents. Netwise has used GPT, which uses data from various channels, including emails and call transcriptions, to trigger specific actions directly in the system. For example, if a customer sends a message that they can’t meet at a previously scheduled time through any channel, even several days in advance, the bot automatically schedules another appointment, having all the customer’s contextual data at hand.

Data reshaping

In many cases, collaborating with partners becomes troublesome when they use different data formats and coding methods. In Nsure’s case, which collaborates with over 60 insurers, data conversion becomes even more critical. Regardless of the format in which partner data enters the system, it goes to Azure Synapse, where it is analyzed and harmonized. Data from various systems’ APIs is used in the entire process, but the GPT model fully handles the conversion from one format to another based on natural language commands. Preliminary data indicates a reduction of over 90% in manual information transfer work between forms and a significant reduction in developer work.

Sentiment analysis

Analyzing the email’s content combined with CRM data allows for highly accurate sales opportunity estimation. Each customer message is meticulously mapped and compared to their historical data. The sales opportunity is analyzed in real-time with each contact. A personalized response proposal is also created, supplemented with all system data, significantly expediting the process and increasing the likelihood of a successful transaction.

Categorization

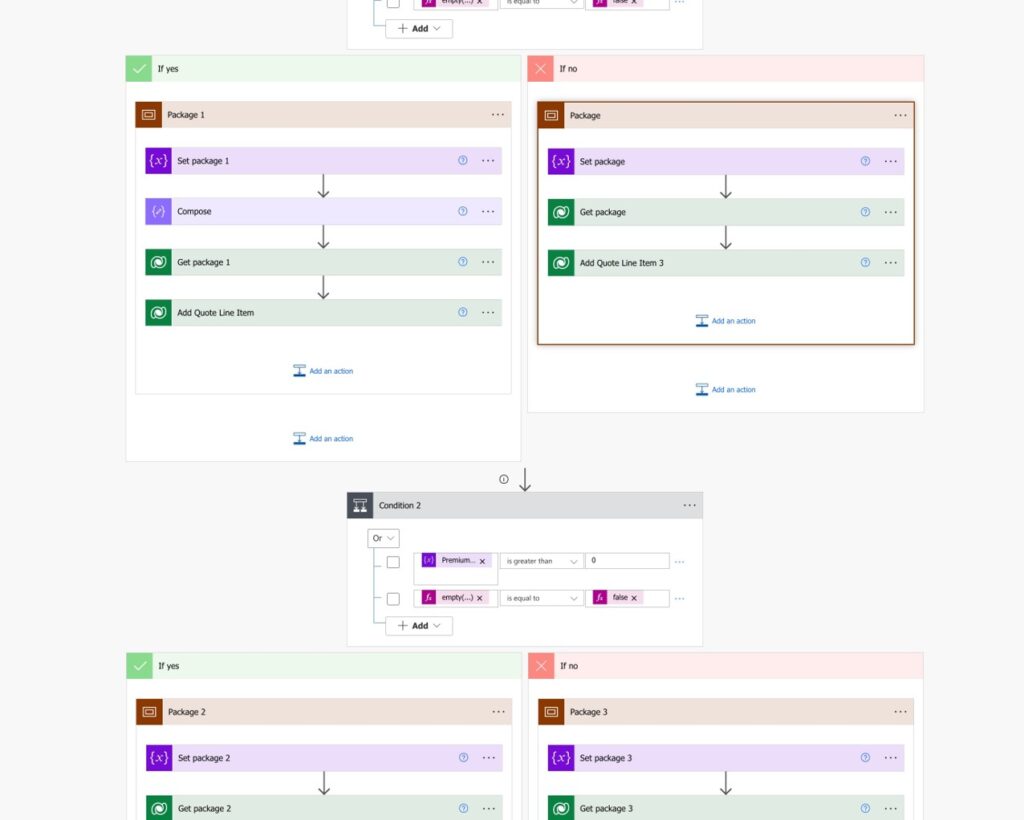

While conventional routing can streamline customer support office operations, involving the GPT model takes customer redirection to a whole new level. Due to a very detailed text analysis, specific cases can be assigned to scenarios. AI fully handles choosing which scenario a particular case belongs to, ensuring that customers are directed to agents with the right qualifications, experience, and, most importantly, that their issue will be resolved within the appropriate time frame. For example, if a customer provides a specific date by which an entire process must be completed (even if it’s the next day), the case is given the appropriate priority and is assigned to someone capable of closing the matter at the right time, without missing a sales opportunity or leaving the customer hanging.

Content Generation

The solution implemented at Nsure lightens the load on agents wherever possible. Therefore, both the message content and the best possible actions to take are generated based on all previous communication and transactional data stored in the system. This increases the chances of cross-selling and up-selling and significantly accelerates the entire process, allowing customers to save time and providing positive experiences. The system itself reminds customers of expiring insurance and suggests the most favorable market option, which can be finalized with just a few clicks.

Two years ago, Nsure declared that over half of all policies were concluded in a self-service model. The new flows not only enable the automation of additional processes but also take this automation to an entirely new level, guaranteeing customer experiences very close to agent support.

In the first three years of operation on the system created by Netwise, Nsure.com gained 700,000 unique users (potential customers and clients), and thanks to automation using Power Automate and GPT, they have already served 300,000 new customers in 2023 alone.

Each customer is described in the systems by over 1,000 data points, resulting in Netwise’s systems, in collaboration with citizen developers at Nsure.com, now analyzing over 1 billion data points in real-time.