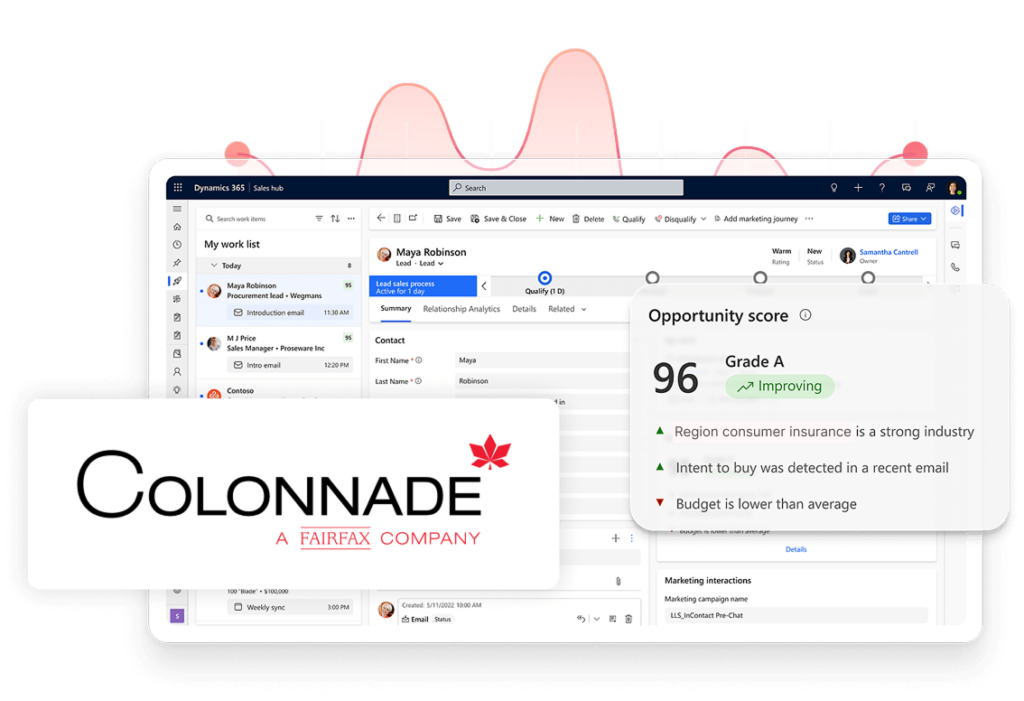

For a multinational insurance business, the ability to make better-informed decisions and sell efficiently is key to growth. Colonnade Insurance wanted to get ahead of the industry and boost their capabilities to serve more customers. Using Dynamics 365 for Sales to standardize their operations, they have simplified and sped up their underwriting process and improved collaboration across the organization.

Colonnade Insurance is a Luxembourg-based business operating in commercial and consumer insurance, focusing on Central and Eastern Europe. Currently, Colonnade has offices in Poland, Slovakia, the Czech Republic, Hungary, Bulgaria, and Romania, and cooperates with insurance brokers and agencies on providing insurance solutions.